Source: Realtor.com

It's time to tune out the chatter, the doom, and certainly the gloom: The American Dream of homeownership is alive and well. Really.

But that doesn't mean it's easy to buy a home these days. So what are the stumbling blocks? Stroke-inducing student loan debt. Soaring home and rent prices, and a lack of properties in many markets. And let's not forget the Great Recession, which set so many would-be buyers back on their heels.

All this has dragged down homeownership rates, which hit 63.9% nationally in the third quarter of the year, according to the U.S. Census Bureau. That's down about five percentage points from their pre-crash high in 2004.

The data team at realtor.com® set out to find those metros where homeownership rates are growing the fastest. In the process, we discovered a few trends. Ownership is shooting up the most in Rust Belt cities undergoing a resurgence; in smaller cities close to much bigger and pricier metros, where commuters can snag a home for less; and in fast-growing Southern hubs that are continuing to experience booming job markets.

Bonus: More than half of the metros on our list boast median prices well under the national median of $274,492.

"Affordability is a strong draw to these areas," says Danielle Hale, chief economist at realtor.com®. A lot of these cities are on the outskirts of big cities where folks can snag an abode for less and then commute downtown for work, she adds.

However, interested buyers had better move fast—all this demand is steadily pushing home prices skyward.

To come up with our findings, the data team analyzed Census data comparing the homeownership rates in the first three-quarters of 2014 to the first three-quarters of 2017. The Census data only included 75 of the largest metros (with some cities moving on or off the list over the years, due to population shifts). Home list price data, from realtor.com, dates from Oct. 1.

So where are the most buyers settling into homes of their very own? Get ready for a few surprises...

1. Milwaukee, WI

Median home price: $224,950

Current homeownership rate: 68.7%

Three-year homeownership change: 11%

After decades of steady decline, this former industrial powerhouse is on the precipice of a game-changing resurgence.

About a hundred large real estate projects are either underway or have recently been finished in the city center. They include a 32-story office tower of gleaming glass and steel, a new, soon-to-be-opened arena for the Milwaukee Bucks, and a 44-story lakefront apartment building with tons of retail space.

No wonder the homeownership rate in Brew City is also taking off. Bidding wars, once unheard of, have become commonplace, and well-priced homes in move-in condition can go for thousands over asking, according to Betsy Head, real estate broker at Milwaukee Executive Realty.

Milwaukee, long under the radar, but the fifth biggest city in the Midwest, is becoming something of a destination stop. For some time, "we haven't had much of any image nationally," says Bret Mayborne, director of economic research at the Metropolitan Milwaukee Association of Commerce. "That's changing."

And the growth is likely to continue, as Foxconn Technology Group plans to open a plant in the suburbs that will employ up to 13,000 workers.

In the city, many buyers seek out condos along the Milwaukee River; most are in rehabbed warehouses, where units can start at $350,000 and go well past $1 million.

The most desirable homes are in more walkable city suburbs about 20 minutes or so outside the city limits. These are mostly older, single-family homes that run from the mid- to high $300,000s to about $600,000.

2. Charlotte, NC

Median home price: $327,050

Current homeownership rate: 62.8%

Three-year homeownership change: 10.5%

Charlotte just keeps growing and growing. It's carved out a niche for itself as a financial hub (it's the nation's second-biggest banking center), and its warmer weather, lower cost of living, and international airport have made it appealing for businesses and for buyers fleeing higher-priced cities.

"We have people moving here from all over," says Sandy Kindbom, a real estate broker at Allen Tate Realtors in Charlotte. She's seeing plenty of transplants from the Northeast, Midwest, and even Florida. And make no mistake: Charlotte has aggressively gone after those newcomers. As Kindbom says, "After the recession, we vastly broadened our types of industries."

As a result, the population of the city shot up about 14.5% from 2010 to 2016, according to Census data.

Many baby boomers and millennial professionals are buying small, single-family houses, townhomes, and condos in mid- and high-rise buildings in the city. Condos and townhouses start around $150,000 and can go into the millions, Kindbom says.

If you're interested in putting down roots here, you'd better get moving: Prices have risen nearly 10.2% in the last year, according to realtor.com data.

3. Memphis, TN

Median home price: $195,050

Current homeownership rate: 61%

Three-year homeownership change: 9.3%

Memphis, known for its finger-licking-good real BBQ and the blues, is also undergoing some big changes. Cranes now dot the former hometown of Elvis Presley. The biggest project is the $7 billion—yep, billion—St. Jude Children's Research Hospital expansion.

"Memphis leaders are making a big push to attract talent to Memphis," says Jimmy Ogle, historian of surrounding Shelby County. "We are going through changes, trying to get to the 21st century."

Those changes are luring more locals from the surrounding area back into the city limits, to enjoy the arts, sports, and growing restaurant scene.

"I'm seeing a lot of empty nesters moving into town, and that's raising prices," says local real estate broker Joe Spake of InCity Realty.

Young professionals are more likely to scoop up single-family houses and townhouses in the city, he says. Anything priced from $150,000 to $300,000 goes fast. Meanwhile, families often prefer master-planned communities in the suburbs.

But it's a seller's market. There are about two buyers for each home going onto the market, Spake estimates.

4. Baltimore, MD

Median home price: $300,040

Current homeownership rate: 68.4%

Three-year homeownership change: 7.3%

Baltimore doesn't often make the news with feel-good headlines. More than 300 people have been killed in the city this year. And just two years ago, the city erupted into riots after the death of Freddie Gray, an African-American man, while he was in police custody.

But Baltimore's proximity to Washington, D.C., just 40 miles away, is its saving grace.

More folks priced out of the nation's capital have been buying homes in Baltimore. That's because the median home price is 30.2% less than in the D.C. metro area. And there are plenty of commuter trains between the cities.

Baltimore has one of the lowest average costs of housing in the region, says Wayne Curtis, a real estate agent at RE/MAX Advantage Realty in Baltimore. In this area, it's often much cheaper to pay a mortgage than to rent.

Much of the housing within the city limits is single-family, row homes that share walls, with a few detached homes sprinkled in. They start at $225,000 to $250,000 in the more desirable neighborhoods, Curtis says.

But buyers be warned: Most of these abodes are about a century old, as the city hasn't seen a lot of new construction.

"Baltimore is a blue-collar city ... so the houses were built for working and middle-class people," Curtis says.

5. Allentown, PA

Median home price: $225,050

Current homeownership rate: 74.8%

Three-year homeownership change: 7.3%

"Well I'm living here in Allentown

And it's hard to keep a good man down

But I won't be getting up today"

— Billy Joel

The Piano Man's 1982 song "Allentown" immortalized the struggles of the real-life Rust Belt city as its factories shuttered. (It still makes us cry.) The next town over was home to Bethlehem Steel, once the nation's second-largest steel producer, which shuttered operations in 1995.

But remarkably, Allentown has found new life as a distribution center, capitalizing on its location just about an hour outside Philadelphia and two hours from New York City. Companies like Amazon, Walmart, and Nestlé have fulfillment centers in the area, while FedEx is building a warehouse and distribution facility.

These blue- and white-collar jobs, combined with low, low housing prices, mean that more locals can now afford to become homeowners. The city is also popular with commuters from Philadelphia and New Jersey seeking cheaper homes and lower taxes.

Row homes and single-family homes, ranging from $250,000 to $850,000, are popular within the city limits, says Joe Golant, a local real estate agent at Weichert Realtors.

"It's common to see homes priced appropriately, in good conditions, go under agreement in a matter of days," he says.

6. Pittsburgh

Median home price: $174,950

Current homeownership rate: 74%

Three-year homeownership change: 7.2%

Pittsburgh, home to the storied U.S. Steel, may now have more in common with Silicon Valley than the rest of the Rust Belt. That's largely thanks to its universities, including prestigious Carnegie Mellon and the University of Pittsburgh, whose grads are being gobbled up by the local operations of tech companies like Google, Uber, and Intel.

Nearly a quarter of the area's workforce is involved in the high-paying tech industry, according to the Pittsburgh Technology Council. And they can get way more for their money in Pittsburgh than in Silicon Valley's San Jose, where the median home price is $1,100,050!

"We've had an influx of a professional workforce moving into the Pittsburgh region, and it created a new pool of [home] buyers," says Bobby West, a real estate agent at Coldwell Banker Pittsburgh. "The cost of living is really attractive. You can buy a house for $100,000, and your mortgage payment is going to be less than your rent."

Many of his clients, however, are younger locals who are choosing to stay in the area instead of setting off for bigger cities. They often prefer the older, single-family abodes that make up the majority of the city's housing stock within the city limits. Those with children tend to go out to the suburbs, where there's a slew of new construction.

Pittsburgh "has been one of those 30-year, 'overnight' successes. [But] it's only been the last couple of years we've been getting attention for it," says Jonathan Kersting, spokesman for the Pittsburgh Technology Council.

7. Albuquerque, NM

Median home price: $239,950

Current homeownership rate: 66%

Three-year homeownership change: 5.7%

Albuquerque was slammed by the recession, with existing-home prices plummeting 8.8% from 2006 to the bottom of the market in 2011, according to National Association of Realtors® data. But the area's mild climate, low home prices, and close proximity to scenic Santa Fe (about an hour away) have helped it rebound—particularly with retirees.

Out-of-state baby boomers make up 10% to 20% of real estate broker Matt Templeton's buyers.

"We've got a huge retiree population from the East Coast, especially from New York," says Templeton, of Templeton Prime Properties at Keller Williams. "We tend to get a lot of people who don't want snowy winters and want to appreciate the [Native American] tribal culture and the mountains."

They are also drawn to the area's bargain-basement prices. The region has both existing and newly constructed homes in the $250,000 range; prices can go as high as $400,000 in the western suburbs of the city, where buyers can snag three- to five-bedroom houses in master-planned developments.

"It's much cheaper to own than rent," says Templeton. The median rent for a two-bedroom apartment in the city is $870, according to Apartment List.

8. Nashville, TN

Median home price: $359,050

Current homeownership rate: 68.8%

Three-year homeownership change: 4.9%

Few iconic American cities have been taking off lately quite like the nation's country music capital, which regularly makes realtor.com's monthly list of the hottest U.S. real estate markets. Home list prices shot up 89% from September 2012 through September 2017. Prices rose 10.8% in the past year alone.

Yet, it's still more affordable—and certainly more relaxed—than many of the bigger cities along the coasts.

"We are very walkable," boasts Nashville-based real estate agent Brian Copeland of Village Real Estate Services. "We have [miles and miles of] greenways of our city."

That's drawn transplants to the Music City; the county's population surged 9.2% from 2010 to 2016, according to Census data.

And builders are taking note. The ambitious Nashville Yards plan will create more than 4 million square feet of retail, hotels, offices, residential, and entertainment spaces over 15 acres. Luxury condos catering to baby boomers are sprouting like kudzu across the downtown area.

Single-family residences dominate the city, and with land growing scarce, builders are now putting up two homes, separated by a wall or fence, on single lots.

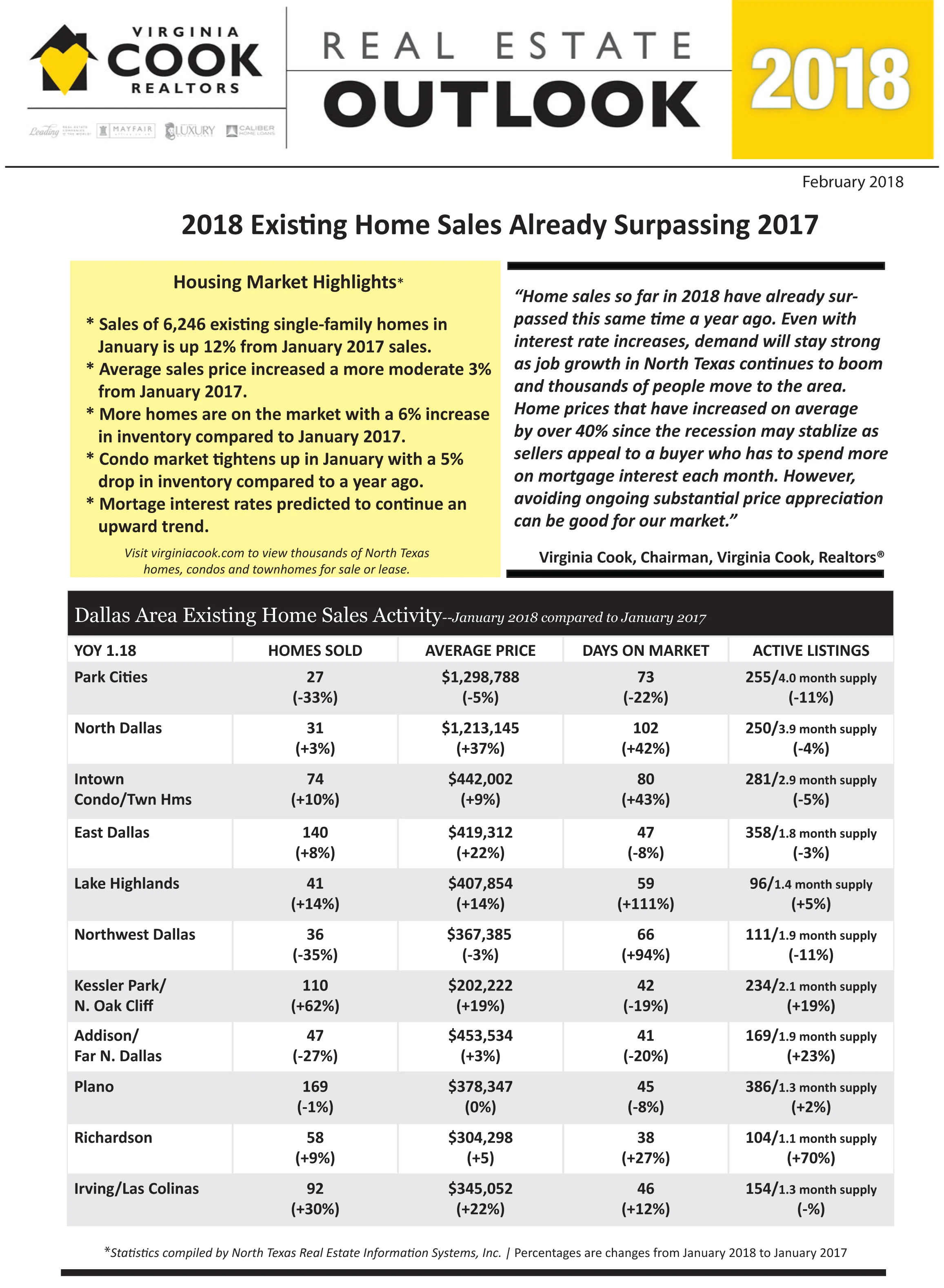

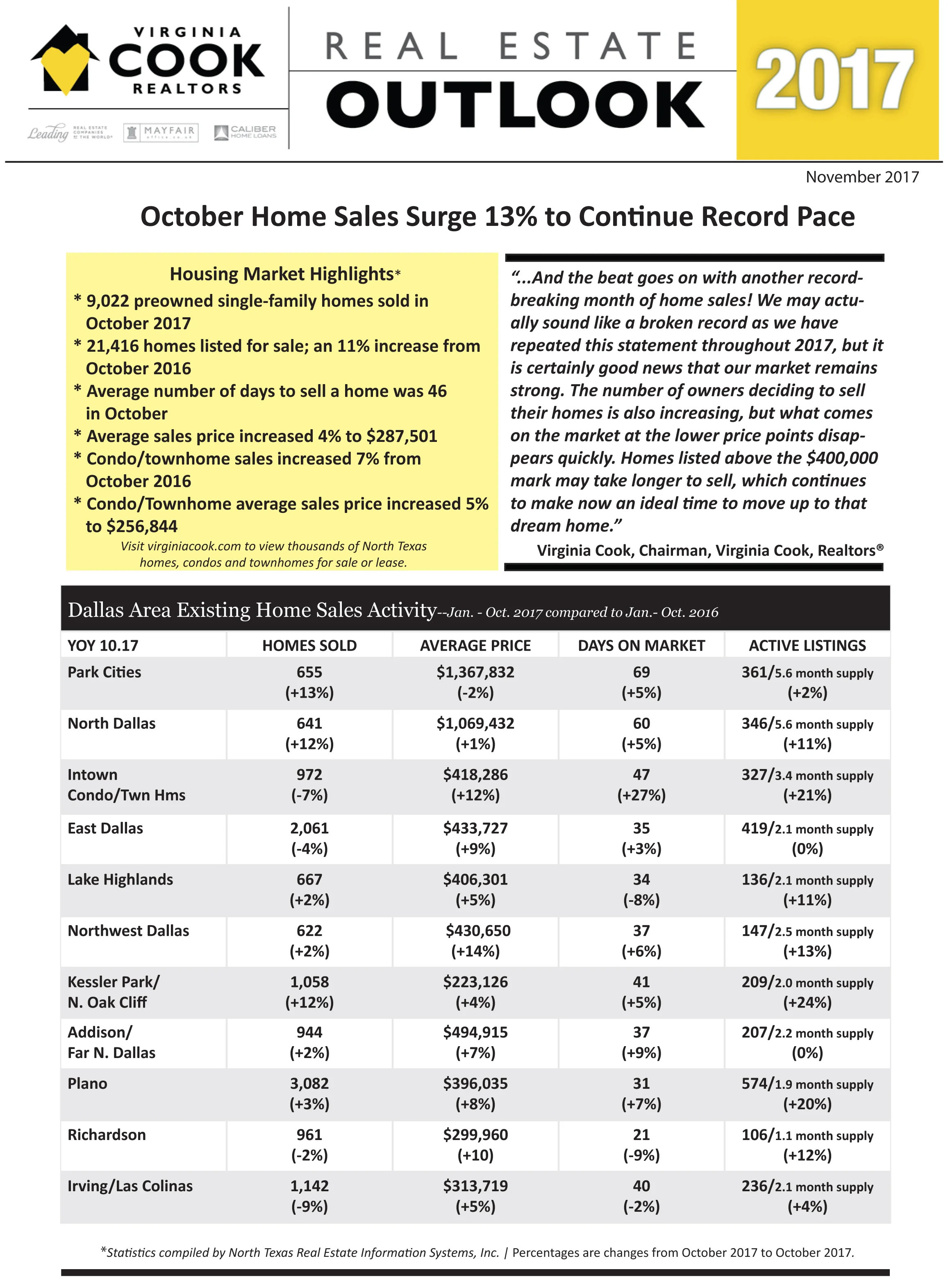

9. Dallas, TX

Median home price: $339,950

Current homeownership rate: 60.7%

Three-year homeownership change: 4.8%

It's no big mystery why the homeownership rate in Dallas is skyrocketing. The Texas city has seen an explosion of companies moving and expanding into the area over the last decade, thanks to its low taxes. About 500,000 jobs have been added to the region since 2010—and all those folks and their families need a place to live.

"We have had a lot of Californians coming to Dallas, because we don't have the state income tax," says real estate broker Debbie Murray of Allie Beth Allman and Associates in Dallas. (She conceded, however, that the state does have high property taxes.)

Dallas newbies often prefer the newer, luxury, high-rise condos downtown. Some come with all the latest amenities, like private elevators, pools, and personal garages in which residents can recharge their Teslas. They aren't cheap: Two-bedroom pads start at $850,000.

Single-family homes are getting progressively more expensive—and scarcer. It's very hard to get anything for $250,000 anymore that's in move-in-ready condition in a desirable neighborhood, Murray says.

10. Syracuse, NY

Median home price: $149,950

Current homeownership rate: 66.5%

Three-year homeownership change: 4.6%

Syracuse, about four and a half hours north of New York City, is a former manufacturing hub that was struggling even before the recession hit, triggering a rash of foreclosures.

But in the last few years, its housing market has been bolstered by a wave of immigrants. Nearly 10,000 refugees from war-torn countries including Syria, Afghanistan, Somalia, Iraq, and Bhutan have been resettled into this region over the last decade.

"There's been a lot of transition from apartments to purchasing their first home," says Glenn Riemenschneider, associate broker at Saya Real Estate in Syracuse.

Often, these are multigenerational buyers looking for two-family houses to accommodate both parents and grown children. And there are deals to be had.

Many of the homes that became foreclosures during the recession are now coming onto the market. And first-time buyers and investors planning to flip the abodes are jumping on them.

Buyers can snag a single-family home for between $80,000 and $100,000 in the city and about $130,000 in the suburbs, Riemenschneider says.

READ MORE